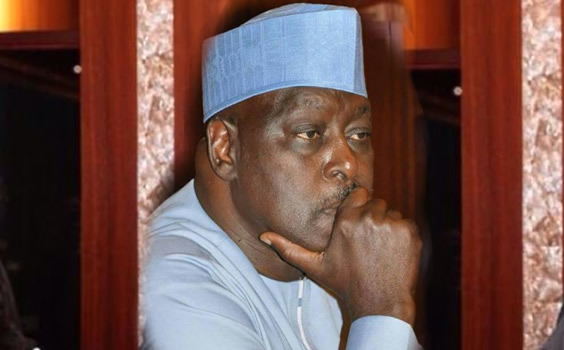

An FCT High Court in Maitama has granted leave to the Economic and Financial Crimes Commission (EFCC) to amend the fraud charge against former Secretary to the Government of the Federation (SGF), Babachir Lawal and three others.

A monitored report states that Lawal was arraigned on a 10-count charge bothering on conspiracy and fraud to the tune of N544million along with Hamidu David Lawal, Suleiman Abubakar, Apeh John Monday and two companies, Rholavision Engineering Ltd and Josmon Technologies Ltd.

They had all pleaded not guilty and were admitted to bail in the sum of N50 million each.

However, at the resumed hearing yesterday, EFCC counsel, Ufom Uket applied to the court for leave to add the company, Josmon Technologies Limited, in count 6, 9 and 10.

The trial judge, Justice Jude Okeke, while granting the leave, informed the EFCC counsel that in accordance with the Administration of Criminal Justice Act (ACJA) he must file a fresh charge.

He also ordered that the defendants should continue on the existing bail conditions.

The judge however held that since the defendants’ counsels complained of the effect of prosecution’s amended charge on their preparation, the court would adjourn the matter to April 11 for the commencement of trial.